USC Global Energy Network (GEN) released a report on the potential economic impact of new oil drilling in California’s Monterey Shale Formation. This work adds to a diverse array of energy-related studies done at USC in recent years. The summary report provides the highlights of the study.

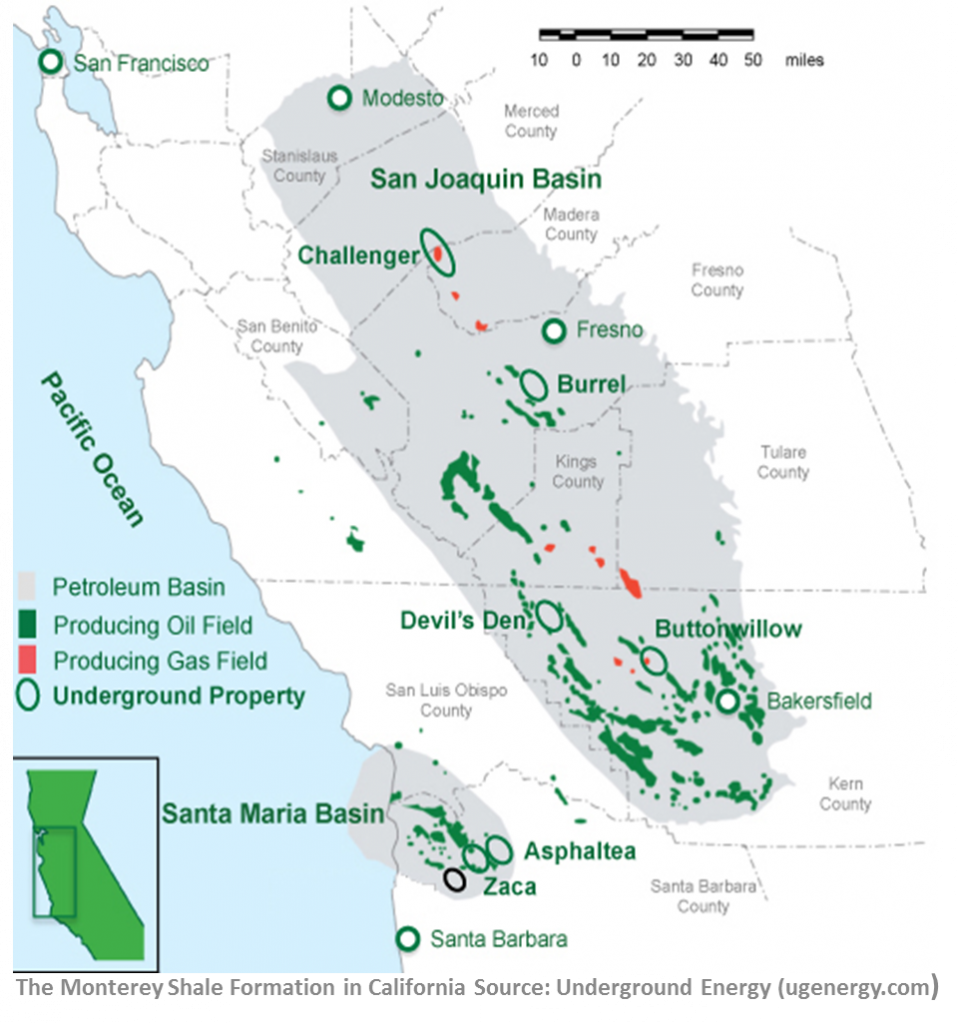

The complete report details an exploratory study on a1,750-square-mile swath of mostly subterranean shale rock that runs lengthwise through the center of the state, with a total potential resource base of 15 billion barrels of oil, representing approximately two-thirds of the shale-oil reserves in the U.S. Reaching the oil locked within the shale requires advanced oil-extraction technologies, including advanced geophysical monitoring technologies, horizontal drilling and hydraulic fracturing, the latter of which may pose as yet undefined environmental risks.

“If you just look at the economics alone, the impact of this unconventional oil development would help stimulate the California economy to a very significant extent,” said USC Price research professor Adam Rose, who coordinated the research efforts for the study. “It would generate a large number of jobs, tax revenue and business throughout the state, not only to oil drilling but to all the industries that support it directly and indirectly, and all the industries that use oil. This really ripples throughout the economy.” The study, however, is only part of California’s total energy picture and did not examine the environmental and other impacts, which will be included in subsequent reports.

The main authors of the new research in the report are Price School professor Peter Gordon and Jiyoung Park, a Ph.D. grad of the Price School and currently assistant professor of planning in the University at Buffalo. Other contributors to the report were Kevin Hopkins and Jack Cox, of The Communication Institutes (TCI).Western States Petroleum Association provided partial funding for the study with the understanding that the research would be completed independently so as to be objective and nonpartisan.

The study and related conclusions were based on careful analysis of available data from the U.S. Energy Information Administration and very limited data from California oil producers. Due to the data limitations, the report represents only a preliminary overview of the economic impact that development of the Monterey Shale could have on California.Using the average of two scenarios, the report concluded that economic effects from enhanced drilling in California would include an increase in the state per capita GDP by $1,600 to $11,000, or by 2.6 percent to 14.3 percent for various years of the time horizon 2015 to 2030. Tax revenues for state and local government is projected to grow by $4.5 billion to $24.6 billion over this period and 512,000 to 2,815,800 new jobs are projected depending on the year.

The authors named six concerns for shale drilling that need to be addressed: potential contamination of water supply, increased seismic activity, land-use challenges, overwhelming small communities, a continued reliance on oil and the air pollution/greenhouse gases that result.

A potential positive benefit that also requires further exploration is that tapping into the large shale oil reserves would significantly reduce the dependence on foreign oil for California and the United States as a whole, contributing to national security. The potential for creating artificial earthquakes already is being looked into by USC’s Induced Seismicity Consortium (ISC). The Center for Sustainable Cities, housed within USC Price, focuses on issues of environmental protection, energy conservation and greenhouse gas reduction policies.

GEN will use current sources of funding from the DOE and the members of its RMC and ISC, complemented with other new funding from a wide range of sources, including foundations, government agencies, industry, environmental and public-interest groups, for further study.“What we would like to do is a comprehensive, interdisciplinary analysis of the many aspects of shale-oil drilling in an objective way,” Fred Aminzadeh, GEN Director,said. “Ideally, subsequent reports will address all the big issues, including the risk and uncertainty.”